A Look Under The Hood At SMID Cap Performance In Q3

October 29, 2025

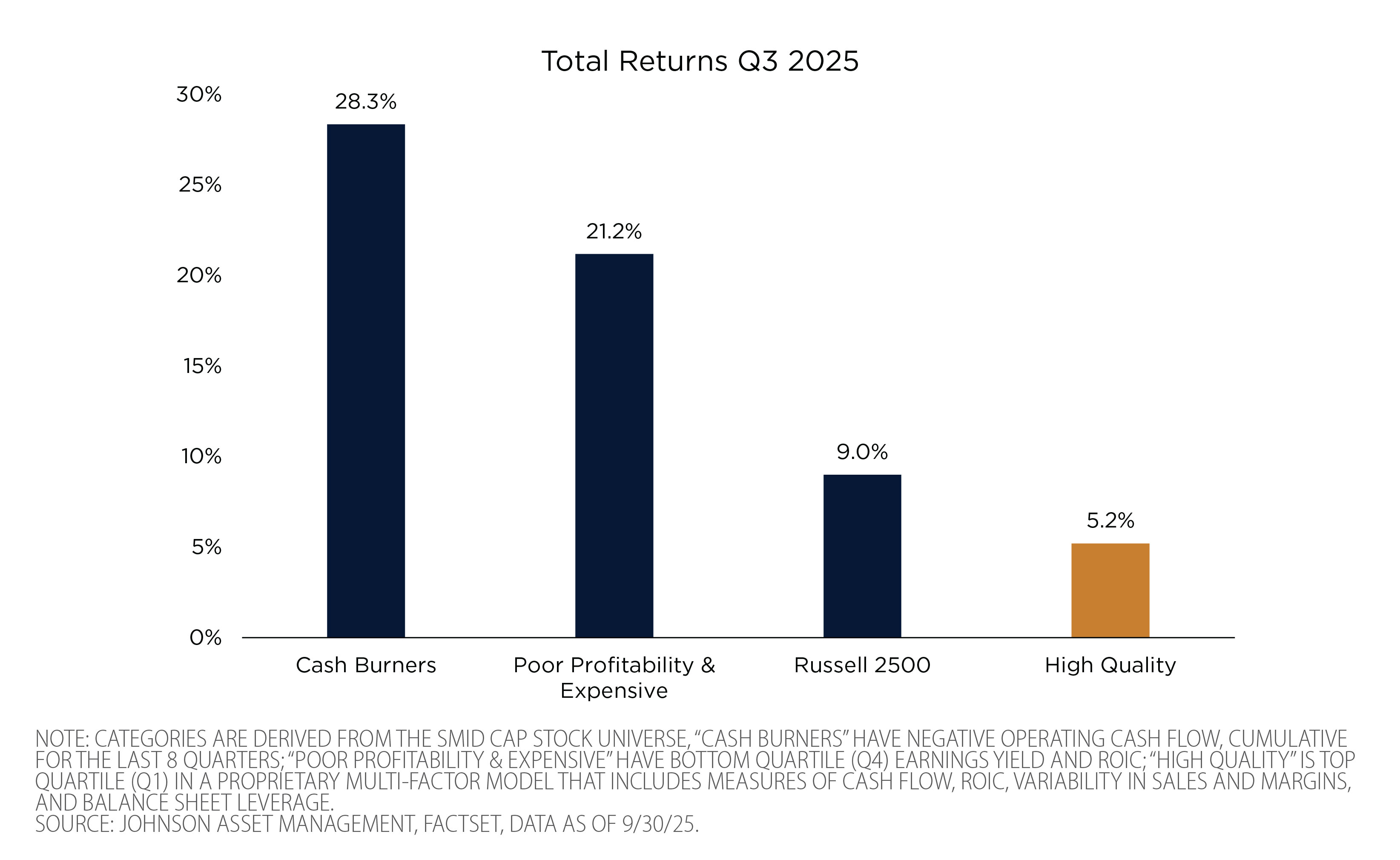

SMID cap stocks continued to rally in the third quarter, with the Russell 2500 index up 9.0%. This rally was predominantly led by lower quality companies. Using multi-factor models, we can isolate the performance of stocks by various quality characteristics. As shown in the chart, some of the lowest quality companies in the SMID cap universe dramatically outperformed their high-quality peers. Over the past 20 years, we have only seen similar outperformance from low-quality companies in two other periods, the 2020 post-pandemic recovery and the 2009 post-GFC recovery. These market dynamics have been a significant headwind for quality-focused active managers but may also present investors with the opportunity to own quality SMID cap stocks at attractive discounts relative to low-quality peers.

Disclaimer:

Johnson Investment Counsel cannot promise future results. Any expectations presented here should not be taken as any guarantee or other assurance as to future results. Our opinions are a reflection of our best judgment at the time this material was created, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events or otherwise.