Financial Conditions Suggest Caution on Credit

May 09, 2023

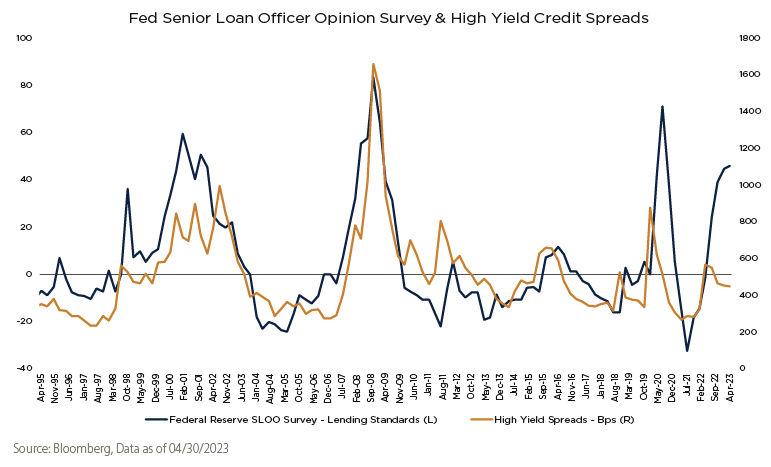

In the midst of this aggressive Federal Reserve rate hike cycle, questions around the effects of tighter financial conditions loom large over the economy. These effects are not only felt by businesses and consumers through increased borrowing costs and higher interest rates; they also take the form of reduced credit availability as lenders raise their standards for making loans. Tighter financial conditions and a more difficult funding environment often place stress on company financials. The chart above highlights the Fed’s Senior Loan Officer Opinion Survey (“SLOOS”), which measures the pulse on bank lending standards. Even before the recent bank turmoil, lending standards have tightened significantly. In addition, we observe the strong correlation between high yield corporate bond spreads and lending standards. Historically, when bank lending standards tighten, bond market standards contract as well, resulting in higher spreads. More recently, this relationship has decoupled, leading us to believe that credit markets may not fully appreciate the effects of increasingly tighter credit conditions. This observation supports our cautious view on the credit environment and our preference for high-quality corporates within fixed income allocations. Spreads, particularly for low-quality companies, do not appear commensurate with the risks associated with slowing economic fundamentals and an increasingly difficult funding environment for companies.

Johnson Investment Counsel cannot promise future results. Any expectations presented here should not be taken as any guarantee or other assurance as to future results. Our opinions are a reflection of our best judgment at the time this material was created, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events or otherwise.