Index Composition Matters For Risk-Conscious Investors

November 06, 2025

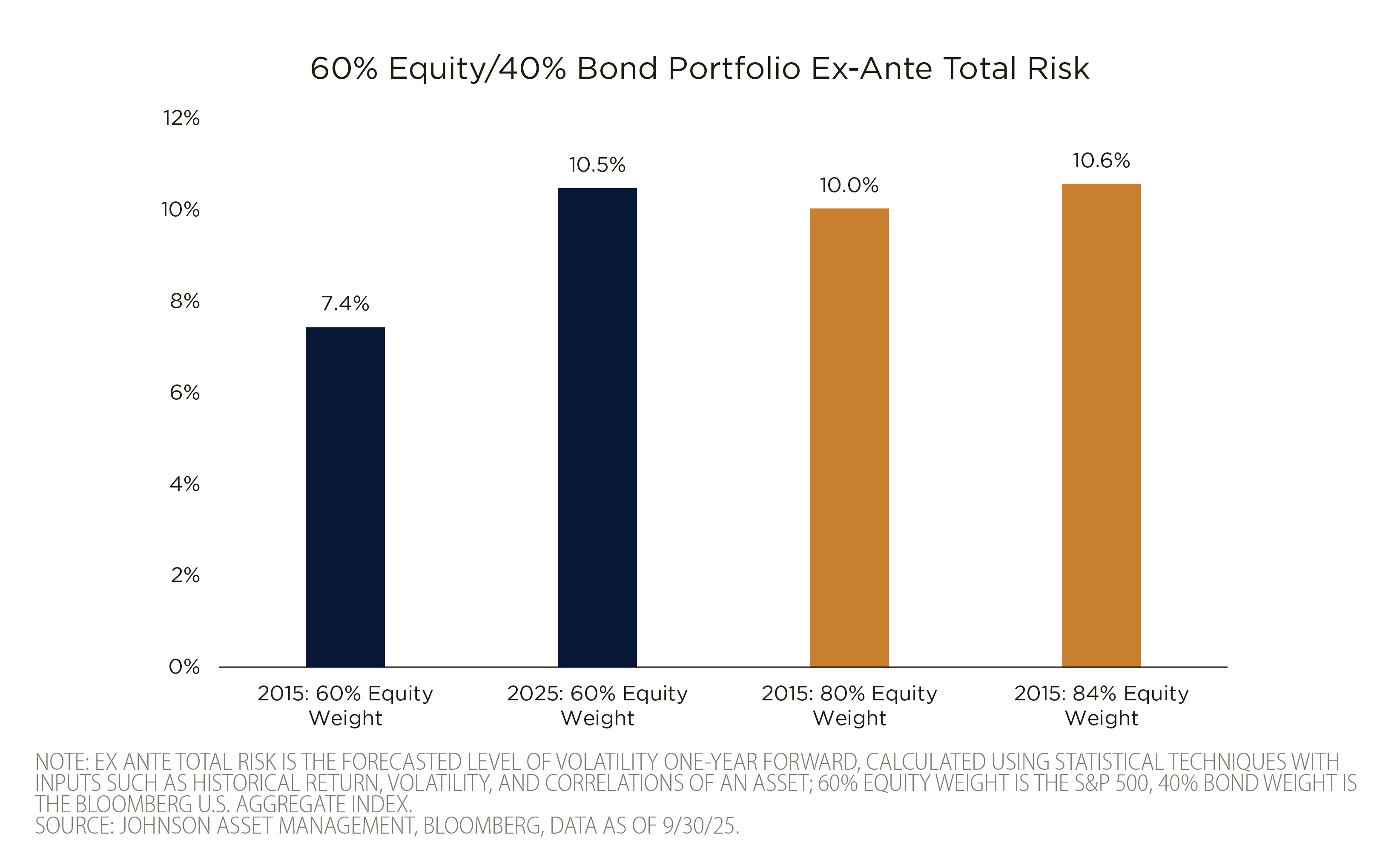

Most discussions of the S&P 500 acknowledge that the extreme concentration in the largest stocks in the index has increased the overall level of risk. We wanted to understand how that translates into client portfolios. Using statistical methods to calculate ex-ante total risk, a measure of expected volatility, we compared a standard 60% equity 40% bond portfolio using the 2015 S&P 500 index composition with the same portfolio today. The results show a 3% increase in expected volatility for a 60/40 portfolio today vs. 2015. Said differently, a 60% equity 40% bond portfolio using the S&P 500 today contains the same expected volatility as an 84% equity 16% bond portfolio in 2015. For asset allocators, it is important to understand how changes to index composition over the past decade have impacted the risk characteristics of client portfolios.

Disclaimer:

Johnson Investment Counsel cannot promise future results. Any expectations presented here should not be taken as any guarantee or other assurance as to future results. Our opinions are a reflection of our best judgment at the time this material was created, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events or otherwise.