Mid Cap: An Equity Market Sweet Spot

June 28, 2023

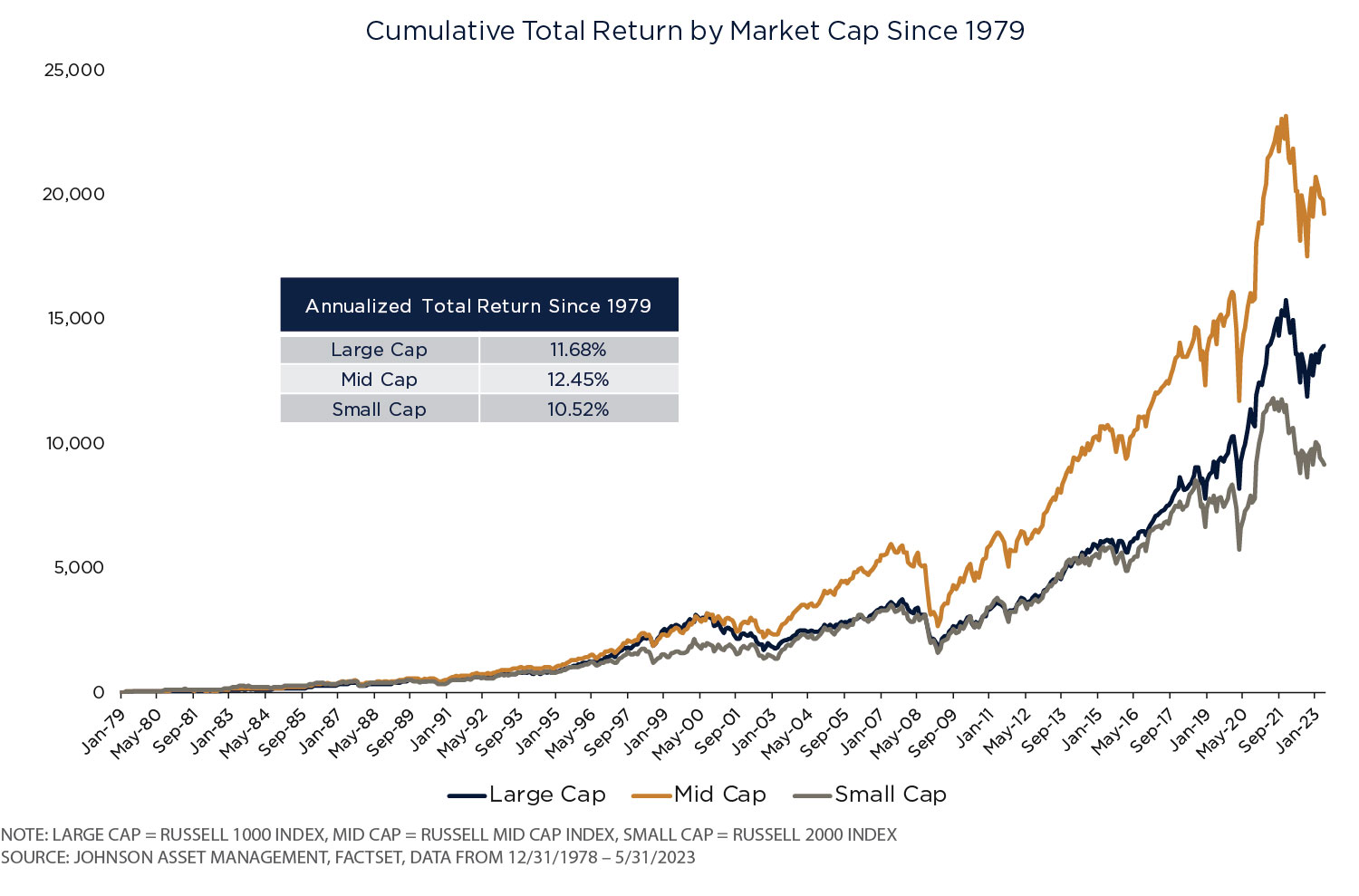

When looking at the domestic equity market by market cap segments, mid cap stocks stand out as a sweet spot for equity investors. The chart above illustrates cumulative total returns by market cap since 1979, showing that mid cap stocks have outperformed both large and small caps over that 40+ year period. The rationale to support this data is fairly straightforward, mid caps combine some of the best attributes of both small and large cap stocks. While often less speculative than small caps with superior financial strength, they are also more likely to be in a sustained growth stage than more established large cap companies. Mid cap stock performance also benefits from the best performing small cap stocks eventually graduating to mid cap, while continuing to operate and perform well. On the flip side, the worst performers in mid cap will eventually fall out into the small cap range. Additionally, with more companies spread out across small and mid cap, there is reduced coverage from buy and sell side analysts, leading to less information and efficiency in these markets as compared to large cap. Lastly, mid caps often have improved liquidity as compared to smaller companies, making them marginally easier for investors to access. While trends such as the macro environment can lead to changes in relative performance leadership across market caps over varying time periods, mid cap stocks combine attractive characteristics of both small and large caps, making them a unique equity market sweet spot over the long run. At Johnson Asset Management, we take advantage of this sweet spot by utilizing a mid cap tilt within our SMID Cap Core equity strategy. For more information, see www.johnsonasset.com.

Disclaimer:

Johnson Investment Counsel cannot promise future results. Any expectations presented here should not be taken as any guarantee or other assurance as to future results. Our opinions are a reflection of our best judgment at the time this material was created, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events or otherwise.